|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

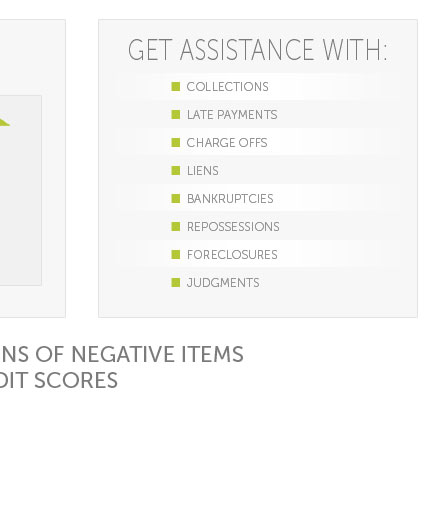

Unlock your financial freedom with Austin's premier credit repair specialist, where we don't just fix credit scores; we transform lives-our expert team delves deep into your unique financial history to craft personalized strategies, turning credit challenges into opportunities and empowering you to achieve your dreams with confidence and clarity-because at Austin Credit Repair, we believe your past shouldn't dictate your future, and we're here to pave the way to a brighter financial horizon, one smart decision at a time.

https://www.facebook.com/austincreditrepairspecialist/

Austin Credit Repair Specialist. 63 likes. We provide one-on-one credit counseling services and help you repair your credit. We also assist business...

Austin Credit Repair Specialist. 63 likes. We provide one-on-one credit counseling services and help you repair your credit. We also assist business...

https://austincreditrepair.net/

Austin Credit Repair offers a simple and stress-free solution for all of your credit score repair needs. Call now for a free credit repair consultation!

Austin Credit Repair offers a simple and stress-free solution for all of your credit score repair needs. Call now for a free credit repair consultation!